Market Update for January 17. 2023

Three items today, one looking backward, one looking forward, and one piece of news related to a recently passed piece of legislation:

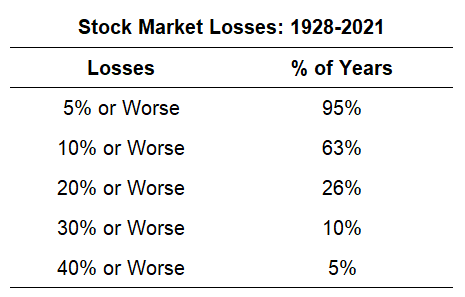

1) 2022 was a tale of two halves for stocks, and I do not see this being reported often. The first half of the year was marked by substantial stock market losses, with the S&P 500 opening at 4,766.18 and closing June 30th at 3,785.38, for a devastating loss of 20.6%. The second half of the year saw a decent amount of volatility but ended December 2022 at 3,839.50, for a second half gain of 1.4% (these figures assume no costs and are not adjusted for dividends, but they are close to what the real experience in that index would’ve been). My point is the common refrain “2022 was bad for stocks,” while true, isn’t quite as accurate as “the first half of 2022 was terrible for stocks, and the second half of the year was roughly neutral.” Bonds are a lot harder to generalize, but if I go by the Barclays U.S. Aggregate Bond Index, the first three quarters were substantially negative and the fourth quarter was modestly positive. Bonds experienced the worst year in several decades, whereas stocks historically lose 20% (but not 30% or more) about 1/4th of the time:

2) Stock and bond markets are off to a decent start in January thus far. Both markets are actually up more so far in 2023 than they were AT ANY POINT in 2022. That is another anomaly to last year- there really was not a moment to look back on and say “I wish I had sold then!” The markets just went down from the get-go. But that is not the experience thus far in 2023. Hopefully the Federal Reserve will taper their rate increases and the stock market will continue to appreciate as 2023 unfolds.

3) Congress recently passed legislation to increase the RMD age for anyone born on or after January 1, 1951.

What is the age where I have to start withdrawing from my tax-qualified accounts?

• 70½ for those born before July 1, 1949.

• 72 for those born between July 1, 1949 and December 31, 1950.

• 73 for those born between January 1, 1951 and December 31, 1959.

• 75 for those born on or after January 1, 1960.

This is more for planning purposes than anything else, and of course I will incorporate these new regulations into my suggestions to clients and our financial planning.